Author

Andy Cagle

Share

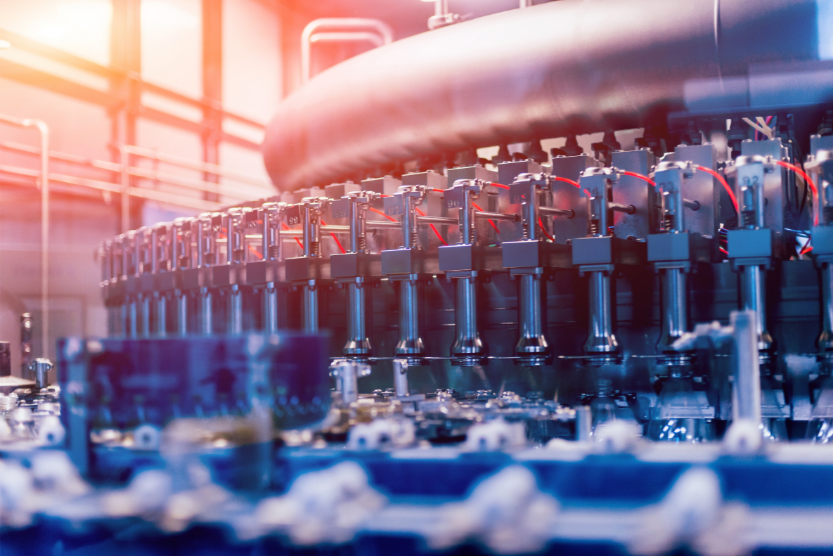

When Indiana-based Rochester Iron and Metal faced extended payment terms from a large buyer, an LSQ supply chain finance program helped save their cash flow from the scrap heap.

Rochester Iron and Metal has a long history of dealing in metallic raw materials. In fact, the company traces its lineage back 50 years to a one-acre scrap yard in Akron, Indiana serving customers in the Northeast part of the state. So with that heritage, the company is definitely an expert in processing scrap metal solids.

The problem it faces is more liquid(ity).

The recent trend for buyers in the steel industry is to push out payment terms to 60 or even 90 days. For a company like Rochester Iron and Metal that deals primarily in quick cash transactions from its suppliers, cash flow becomes a problem with their days sales outstanding (DSO) are stretched so far.

The recent trend for buyers in the steel industry is to push out payment terms to 60 or even 90 days. For a company like Rochester Iron and Metal that deals primarily in quick cash transactions from its suppliers, cash flow becomes a problem with their days sales outstanding (DSO) are stretched so far.

“Most of our suppliers get paid very quickly,” said Rochester COO Dan Zeiger. “Our consumers, the steel mills, used to pay in 45 to 60 days, generally speaking, so cash flow was manageable.”

But when one of its largest customers extended terms to 90 days, Rochester felt the crunch. “When we were looking at 1.5 or 2 times as long to turn around the cash,” Zeiger said, “we had a little bit of hesitancy to do business with them.”

However, Rochester’s customer provides a supply chain finance (SCF) early-payment payment for its suppliers through LSQ and Zeiger investigated the option and found it to be a good fit to solve his company’s cash-flow concerns.

The LSQ Solution

“We did want to continue to do business (with the company),” he said. “When the LSQ program came along, we were able to create a scenario where we were able to comfortably do business with the customer again.

“LSQ brought them a lot closer to the terms we needed to make them a viable consumer.”

According to Zeiger, Rochester has been able to cut their terms from net 90 to net 60 with the SCF program through LSQ FastTrack®. He likes the option to get paid sooner than 60 days if the need arises. “There’s a level of reliability within this financial tool that creates a comfortable feeling as far as our payment cycles and our receivables go,” said Zeiger.

“Set it and Forget it”

Without an easy-to-use software solution, the financial part wouldn’t have much value to a small company like Rochester, but Zeiger and team have found the automation in FastTrack to be an essential time saver and integral part of their accounts receivable process. In fact, they have had such success with the tool that they have chosen to take part in beta testing within the platform.

“It’s easy and straightforward,” Zeiger said. “I can look at an invoice and I can see clearly the fee rate, the fee, the status, all the information that I need as far as doing the accounting functions of the business.”

When Indiana-based Rochester Iron and Metal faced extended payment terms from a large buyer, an LSQ supply chain finance program helped save their cash flow from the scrap heap.

Rochester has taken advantage of, FastTrack’s automatic set-your-own-terms feature that allows users to set their payment terms (for Rochester, 60 days). Once set, approved invoices get paid automatically on a certain date after approval without the staff having to do anything else in the system. “I love that we can ‘set it and forget it.’ It takes the guesswork out of when payments will come in.”

The Best Option

Rochester has participated in other consumers’ early-payment programs and found the costs to be more than they were comfortable with or too cumbersome to be effective. “Some of the other advanced-payment options brought to us by various mills that we do business with either the rate is quite a bit higher or untenable as far as pulling those payments in all the time,” said Zeiger.

“I would say the LSQ program is very fair as far as cost per number of days.”

As for the technology, Zeiger says there is no learning curve for teaching new team members how to use FastTrack. “We brought in someone new and showed her the system and it was so intuitive, she didn’t need any training.”

For anyone in the steel business, Zeiger thinks taking part in an LSQ SCF program is a no brainer.

“I would say ours is the best industry to take advantage of a supply chain finance program with LSQ,” he said. “I would recommend anyone look into it if they want to improve their cash flow and gain certainty and reliability of payments.”

This program was made possible through an Export-Import Bank of the United States (EXIM) Supply Chain Finance Guarantee. The EXIM SCF Guarantee Program incentivizes lenders to fund supply chain finance programs for US exporters by reducing risk, increasing availability, and lowering costs.

LSQ is an EXIM-approved lender and supply chain finance platform provider.

Stay in the loop

![LSQ-merger_Logo_Stacked_white[84]](https://www.lsq.com/wp-content/uploads/2025/02/LSQ-merger_Logo_Stacked_white84-200x97.png)