WORKING CAPITAL TO MAXIMIZE ENTERPRISE VALUE

How Does LSQ Help in Value Creation?

While every portfolio company is unique, there is one constant: the need for working capital to enhance enterprise value.

That’s why LSQ provides portfolio companies of all sizes with easy-to-use solutions for their cash-flow needs through LSQ FastTrack. By offering a myriad financing options, we can tailor a program that fits any business – from lower mid-market to enterprise.

LSQ’s unique offerings help portfolio companies increase value through

Working Capital

Time to Value

Cost Savings

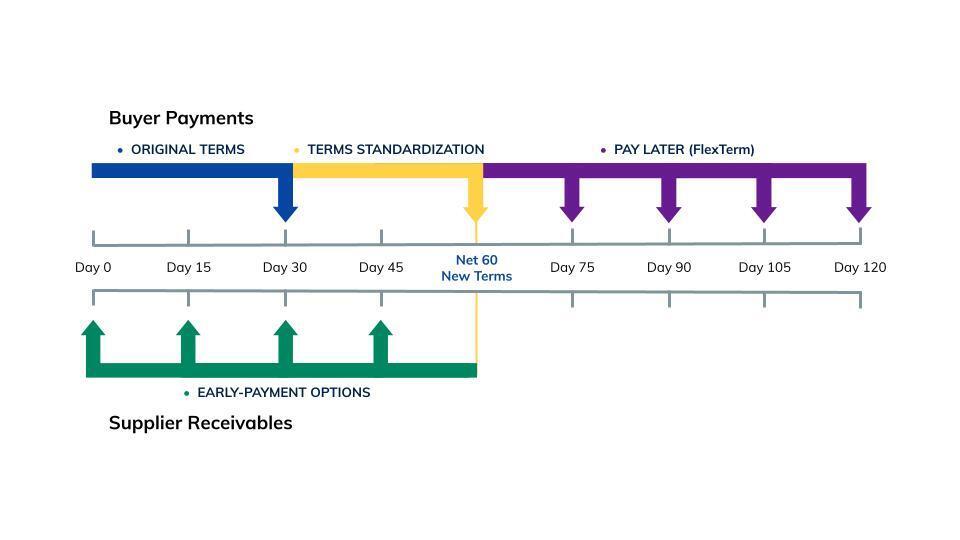

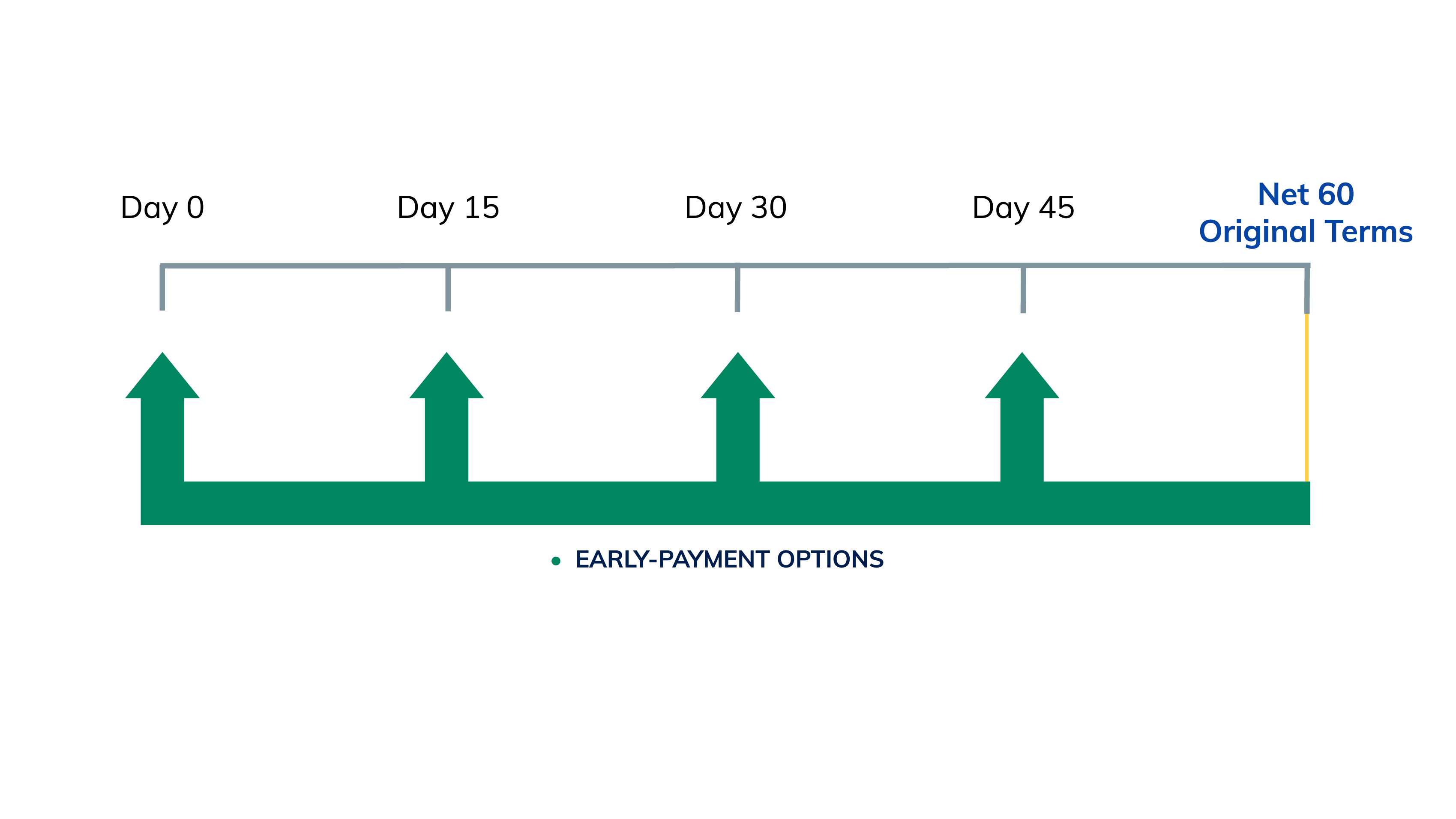

IMPROVING THE CASH CONVERSION CYCLE

Control When You Pay and Get Paid

With a supply chain finance program through LSQ, portfolio companies tap into third-party funding to extend their days payable outstanding, while suppliers gain on-demand access to payments to keep their business moving forward.

With our invoice finance solutions, LSQ provides PE-sponsored companies with the flexibility of when to get paid and control of costs, dramatically cutting their days sales outstanding and keeping their businesses growing – no matter the payment terms.

ON-DEMAND WEBINAR FT. THE CARLYLE GROUP

Private Equity PortCos: Working Capital Opportunities & Partnerships

In this webinar featuring Adam Cummins, Principal, Portfolio Procurement at The Carlyle Group, you will learn:

What opportunities were available to a large private equity firm when they looked at the current state of their supply chain and working capital position coming out of the pandemic.

What finance and technology levers they used to take advantage of those opportunities.

How they chose a partner to help them achieve their ambitious goals.

![LSQ-merger_Logo_Stacked_white[84]](https://www.lsq.com/wp-content/uploads/2025/02/LSQ-merger_Logo_Stacked_white84-200x97.png)